Лазерная резка меди – это современный и высокотехнологичный процесс, который позволяет с высокой точностью

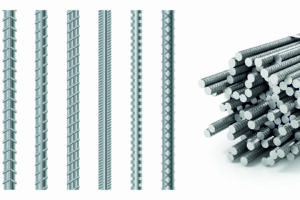

Арматура является неотъемлемой частью современного строительства, играя ключевую роль в обеспечении прочности и долговечности

Пенообразователи являются важным компонентом системы пожаротушения, предназначенным для создания пенообразной пленки на поверхности горящего

Иногда для расширения пространства или для дизайнерского решения в жилом помещении возникает необходимость в

Зимний монтаж имеет достаточно противоречивые отзывы. С одной стороны, работ становится больше, поскольку кроме

В поисках чистой и доступной воды многие жители Минска и Минской области обращаются к

Автоматические модульные котельные представляют собой инновационное решение для обеспечения отопления в различных типах зданий.

Современный рынок моды часто обращает внимание на специализированные ниши, и одним из ярких примеров

ООО ТД "Технологии Достижений" в Ростове-на-Дону предлагает широкий выбор строительных красок и гидроизоляционных материалов

Песчаник для дорожек - отличный выбор для создания эстетичных и функциональных элементов ландшафтного дизайна.

Специфика летних шин заключается в особой резиновой смеси и рисунке протектора, который разработан для

Благодаря широкому выбору дизайнов, высокому качеству и прочности, он пользуется популярностью у потребителей.

Современный ремонт и дизайн интерьера невозможны без использования инновационных материалов. Они не только обеспечивают

Букеты с пионами являются вершиной элегантности и изысканности в мире флористики. Пионы – это

Облицовочный камень, декоративный камень и искусственный камень – это популярные материалы, используемые для отделки

Теплый пол под ламинат становится все более популярным среди потребителей, поскольку это решение позволяет

Использование промокодов позволяет покупателям существенно снизить свои расходы, делая покупки более доступными и приятными.

Существуют различные методы продвижения в социальных сетях, каждый из которых имеет свои преимущества и

Укладка клинкерной плитки требует определенных навыков и знаний, поскольку качество выполненной работы напрямую влияет

Вентиляторы на 220 вольт являются важным элементом в системах вентиляции и охлаждения как в

Каждый интернет-магазин, который дорожит своей репутацией, должен серьезно отнестись к вопросу организации доставки товаров

Выбор отопительных приборов для загородного дома — это важный и ответственный процесс, который требует

Эффективные системы подметания оснащены вращающимися щетками, которые собирают мусор и пыль, оставляя поверхность дороги

Владельцы частных домов часто сталкиваются с проблемой качества воды, особенно если она поступает из

Такая разновидность металлопроката как б/у трубы позволяют это сделать это без потери качества. Согласно

Встраиваемая бытовая техника устанавливается необязательно только из-за стильного дизайна: такой вариант помогает оптимизировать имеющееся